The price of gold has reached new highs. In 2017 I wrote to subscribers:

Since 1913, the year the Federal Reserve was created, the purchasing power of the U.S. dollar has fallen 96%. The purchasing power of a single ounce of gold over that same time period has more than doubled. That is no coincidence. Gold is a store of value—a wealth preservation vehicle. Gold won’t make you rich, but it also won’t make you poor. Gold is a currency. It can’t go bankrupt, lose its value because of poor management, accounting fraud, world war, or hyper-inflation. Investors who truly understand gold recognize that gold should be counted in ounces, not in dollars. Because while the dollar value of gold may fluctuate from year-to-year, it will be worth many times its current value during the next generation and in those that follow.

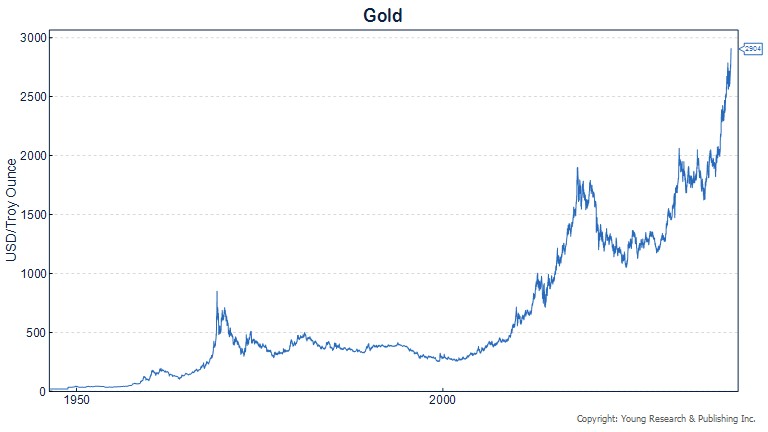

As you can see on my chart below, gold is now at all time highs of over $2,900/ounce.

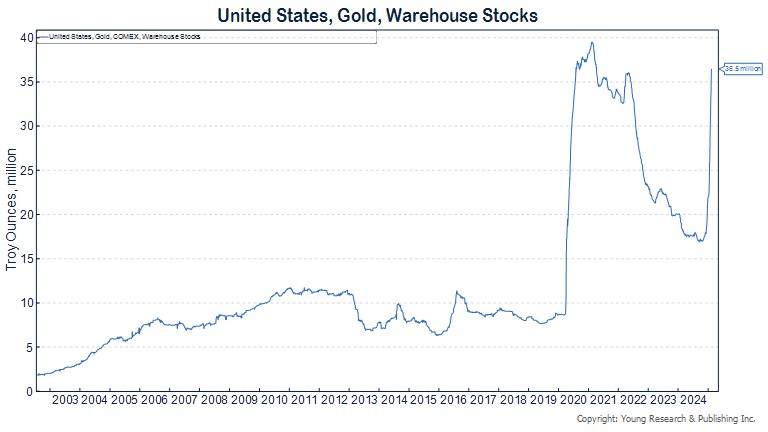

Demand for gold has caused inventory spikes at Comex warehouses:

But annual gold production growth in 2024 was only 1.5%, the same as it has been on a compound annual growth basis since 1969.

Demand for gold seems to be increasing, and production of gold has not been able to grow rapidly for some time and even sits today at slightly less than that of 2018. Silver production, too, has fallen, though the dynamics of that metal are somewhat different.

Another piece I wrote back in 2010 seems relevant today as DOGE rips into the operations of the bloated federal government and finds waste, fraud, and abuse throughout. I wrote:

The Great Money Flood

Inflation is a disease. After WWI, hyperinflation—when prices sometimes doubled and more than doubled from one day to the next—prepared the ground for Communism in Russia and Nazism in Germany. The story is told in Milton and Rose Friedman’s Free to Choose. As the Friedmans correctly point out, no government is willing to accept responsibility for producing inflation. The Friedmans present readers five simple truths that embody most of what we know about inflation. First, inflation is a monetary phenomenon arising from a more rapid increase in the quantity of money than in the output. Second, government determines or can determine the quantity of money. Third, there is only one cure for inflation: a slower increase in the quantity of money. Fourth, it takes time, measured in years not months, for inflation to develop; it takes time for inflation to be cured. Fifth, unpleasant side effects of the cure are unavoidable

The Problem Starts With Government

Milton and Rose point the bony finger of blame at government. I have agreed with the Friedmans for decades. In 1978, I began Young’s World Money Forecast to write about inflation and inflation’s cousin: gold and currency debasement. In 1987, I wrote a book, Young’s Financial Armadillo Strategy, to further the discussion of inflation, gold and currency debasement in terms of investment portfolios. In the years since, I have found no reason to change or adapt my original approach to portfolio management based on the basic Friedman conclusions on government and inflation.

Government is where the problems start. And the bigger, more intrusive the central (as opposed to state) government becomes, the greater my concern for your and my welfare in both financial and personal security terms. An ongoing study and appraisal of central government is the only place to begin analysis of the climate for investing, business in general, and certainly your family’s personal security. An incorrect appraisal of the intentions of those charged with governing our country makes proper action regarding financial and personal security impossible. It’s just that simple.

There’s talk of putting former Congressman Dr. Ron Paul in charge of an audit of the Federal Reserve. That would be a great start in healing America’s broken monetary and fiscal systems. I’ll be watching, and writing about the developments surrounding gold, Ron Paul, the Fed, and your dollar. Click here to subscribe to Young’s World Money Forecast, your port in a storm.