Riding the yield curve and compounding decades of dividends. Practicing the faith of Ben Graham’s margin of safety, and honoring the Prudent Man Rule. I still write daily. You’ll find me on our family websites, so don’t miss out.

The Story of Roger Babson and the Great Depression

Roger Babson, entrepreneur und business theorist from Massachusetts, between 1905 and 1945. Photo by Harris & Ewing, courtesy of the Library of Congress.

After successfully predicting the crash that led to the Great Depression, Roger Babson was vilified as though he were its cause. At Doug Casey’s International Man, Jeff Thomas explains the history of Roger Babson, founder of Babson College, which I attended.

“[A] crash is coming, and it may be terrific. …. The vicious circle will get in full swing and the result will be a serious business depression. There may be a stampede for selling which will exceed anything that the Stock Exchange has ever witnessed. Wise are those investors who now get out of debt.”

The above words could easily have been stated by me or another of the (very) few others who currently predict the coming of crashes in the markets.

But they were not. The statements above were made by investor Roger Babson at a speech at the Annual Business Conference in Massachusetts on 5th September, 1929.

Mr. Babson’s prediction was not a sudden one. In fact, he had been making the same prediction for the previous two years, although he, in September of 1929, felt the crash was much closer.

News of his speech reached Wall Street by mid-afternoon, causing the market to retreat about 3%. The sudden decline was named the “Babson Break.”

The reaction from business insiders was immediate. Rather than respond by saying, “Thanks for the warning—we’ll proceed cautiously,” Wall Street vilified him. The Chicago Tribune published numerous rebuffs from a host of economists and Wall Street leaders. Even Mr. Babson’s patriotism was taken into question for making so rash a projection. Noted economist Professor Irving Fisher stated emphatically, “There may be a recession in stock prices, but not anything in the nature of a crash.” He and many others repeatedly soothed investors, advising them that a resumption in the boom was imminent. Financier Bernard Baruch famously cabled Winston Churchill, “Financial storm definitely passed.” Even President Herbert Hoover assured Americans that the market was sound.

But, 55 days after Mr. Babson’s speech, on 29th October, 1929, the market suddenly went into a free-fall, dropping 12% in its first day.

Today, most people have the general impression that on Black Friday, the market crashed and almost immediately, there were breadlines. Not so. In the Great Depression, as in any depression, the market collapsed in stages. The market did not reach its bottom of 89% losses until July of 1932.

Along the way, thousands of banks and lending institutions went belly-up. Thirteen million jobs disappeared.

And of course, the political leaders of the day did their bit. They implemented knee-jerk “solutions” that actually worsened the situation. Restrictive tariffs, gold confiscation, and a more dominant government were employed, just as they will be this time around.

So, as the market tumbled, we would imagine that Babson came to be praised by Wall Street for his insight, but in fact, the opposite occurred. Having accused him of being utterly incorrect in September, they later accused him of having caused the depression.

So, was Babson’s prediction a lucky guess? Did he simply observe the bull market and arbitrarily predict the opposite of the trend of the day to see what would happen? Not at all.

Such predictions are not guesswork, nor are they attributable to a vision seen in some crystal ball. Such crashes are entirely predictable. When any major bull market becomes overbought; when too many investors begin buying on margin because they can’t come up with the purchase price for stocks; when they then become even more obsessive and borrow money to buy on margin, the market has become a house of cards, waiting for the slightest breeze to come along.

Read more here.

MY PAYDAY INDICATOR: Are You Getting Paid to Invest?

UPDATE 10.14.24: In September, the Federal Reserve did cut rates by 50bps and signaled another 50bps in cuts by the end of 2024. I’ve updated my Payday Indicator chart below so you can see the diminishing yield investors can expect on their money.

Originally posted August 2, 2024.

The market believes the Federal Reserve is poised to cut rates in September and that the Fed could cut them by 75 basis points by the end of the year. Of course, this analysis comes after the market completely misjudged the Fed’s intentions about cuts in December 2023. So, take all predictions with more than a grain of salt. But comments from Jerome Powell and other Fed officials indicate they may be more seriously considering cuts now than last year.

Long-time readers will remember my Payday Indicator, an indicator based on stock and bond yields that gives an approximation of the yield on a balanced portfolio. I have used this basic calculation as my guide since I graduated from Shaker Heights High School, listening to Chuck Berry in the late ’50s. I’ve watched this number for over six and half decades, and for most of the last two, investors weren’t getting paid nearly enough. Historically low Federal Reserve rates sapped the yield investors could expect to earn on their money. Only since 2022 has my indicator returned to something remotely normal, though nowhere near what it was in the 80s or even the early 90s.

For now, you’re still getting paid to invest, but with the Fed poised to potentially cut rates, that may not last for long. Act accordingly. Click here to find your port in a storm and sign up for my email alert.

What the Iran Situation Means for Gold

UPDATE 8.22.24: Tensions are once again high in the Middle East, with a war between Israel and Hamas underway and the prospect of Iran and its allies taking a more active role against Israel. Iran has promised strikes against Israel in retaliation for Israel’s killing of Ismail Haniyeh, a top Hamas official, on Iranian soil. Rather than strike back right away, Iranian leaders suggest strikes will come at a time of their choosing. With the Middle East ready to boil over and many other parts of the globe in turmoil, is it any wonder gold is hitting all-time highs? Take a look at my chart below.

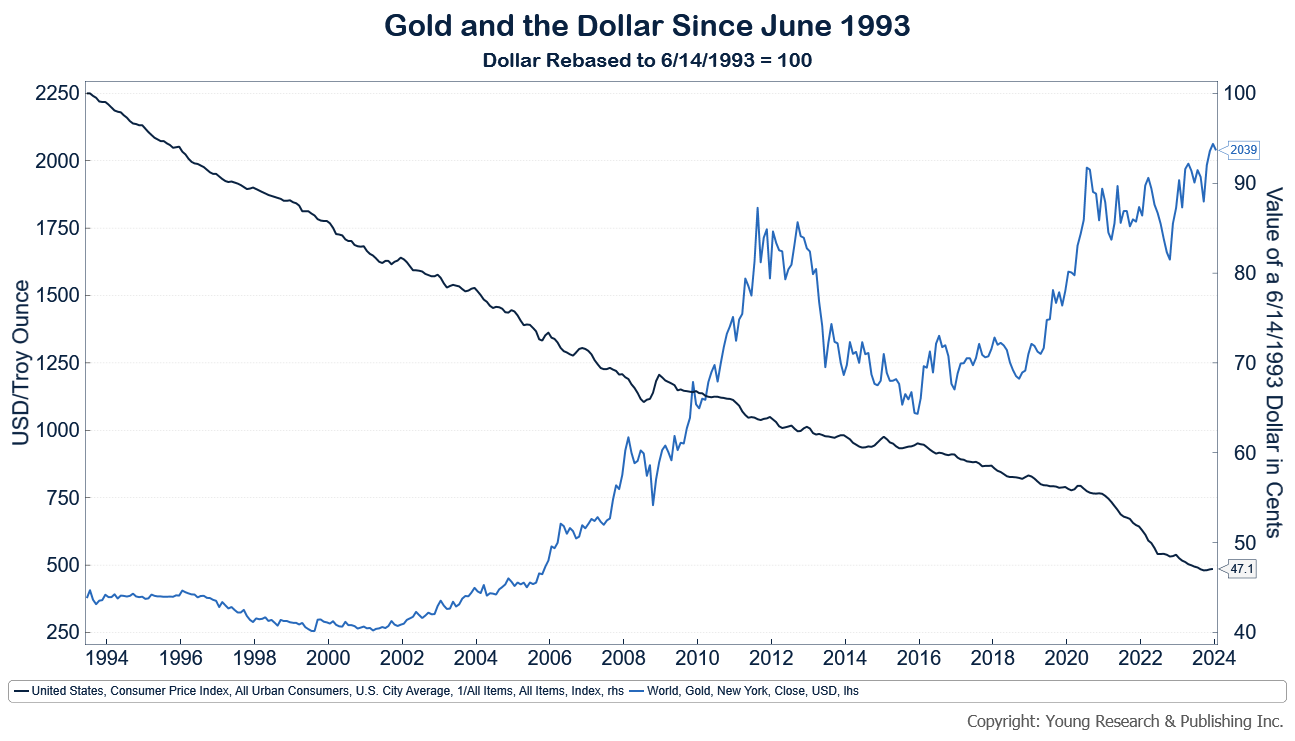

Geopolitical fear is only one component of gold’s rise. As you can see in the chart below, inflation is also playing a role. Despite gold reaching new highs in nominal terms, in real terms, gold’s price is elevated, but nowhere near its all-time highs of the 1980s.

Originally posted on January 9, 2020.

Since the end of 2019, gold prices have been on a breakout trajectory. Now, in response to rising tensions with Iran, things are getting very interesting.

The news that the United States had bombed Iranian Major General Qassem Soleimani increased the perception of risk in the Middle East and drove the price of gold even higher.

I have always suggested to investors that they maintain a gold component in their portfolios, not as a road to riches but as an insurance policy against inflation, disaster, and war. Typically, when every other asset’s price is falling, gold’s is rising.

Here’s how I explained it back in 1986:

Throughout history gold has been the money of last resort. Every central bank in the industrialized world holds gold as an international reserve asset. Countries like Switzerland maintain a high percentage of gold holdings in relation to total money supply.

What is the proper course to take in building a gold cornerstone for investment portfolios? Most individuals look to bullion coins, mining shares, and gold certificates from major banks. I like certificates when an individual has no interest whatsoever in gold and invests in gold strictly as a portfolio tool. Certificates also have appeal for institutional investors. Gold mining shares should not be used as a gold proxy for cornerstone positions.

Gold share mutual funds should be considered in the stock fund section of one’s portfolio, but not in the gold cornerstone section. Shares are subject to political and natural disruptions that invalidate their inclusion as gold cornerstone investments.

Since I wrote those words, a lot has changed in the way Americans can invest in gold. The creation of gold-backed ETFs was probably the most significant development. To learn more about how to invest in gold today, click here.

If you would like to understand how my family-run investment counsel firm uses precious metals to craft counterbalanced portfolios, sign up for Richard C. Young & Co., Ltd’s monthly client letter. The letter is free, even for non-clients. You don’t want to miss it.

The Reason the Fed Keeps Interest Rates Low

On July 15, 2024, Chair Powell participated in a discussion at the Economic Club of Washington, D.C.

At the Ron Paul Institute for Peace and Prosperity, former congressman and presidential candidate Dr. Ron Paul explains that the “desire to monetize the federal debt is one reason, if not the main reason, why the central bank keeps interest rates low.” He writes:

Politicians favor an “easy money” policy because it creates an (illusionary) economic boom. The Fed-created boom helps the politicians remain in office. A reason politicians favor low interest rates is they facilitate government spending and debt, thus enabling politicians to aid powerful special interests via government spending. The desire to monetize the federal debt is one reason, if not the main reason, why the central bank keeps interest rates low.

The policy of perpetually low interest rates favored by politicians will hasten the inevitable collapse of the fiat money system.

He concludes:

Since Congress created the Fed in 1913, the US dollar has lost over 97 percent of its purchasing power. This proves Donald Trump is right about the need for drastic changes in monetary policy. However, he is wrong to think that he, or any politician, bureaucrat, or businessperson, is capable of knowing the “correct” interest rate. Instead of giving politicians greater ability to influence the Federal Reserve, the next president should work with Congress to pass legislation legalizing competing currencies, forbidding the Fed from purchasing federal debt, and auditing and ending the Federal Reserve.

You can see what Paul is referring to in the charts below. The first is the total marketable and non-marketable public debt of the United States.

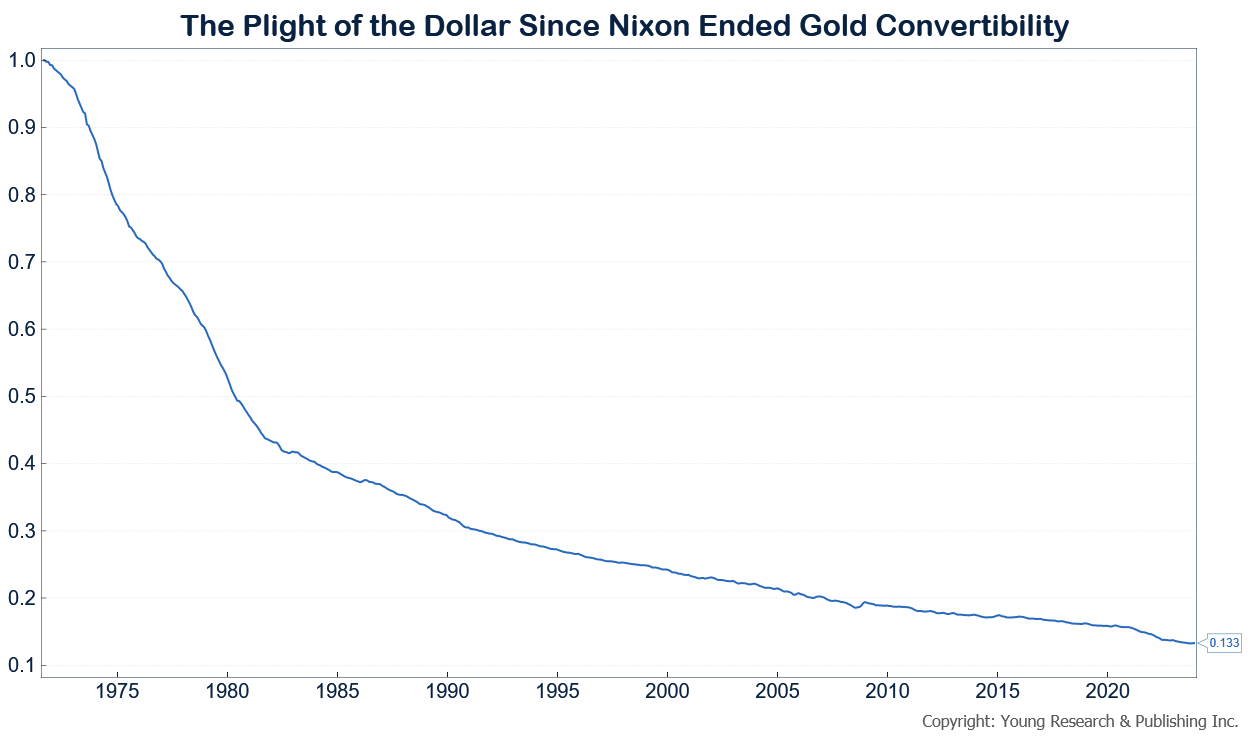

The second chart is a visual of the plight of the American dollar since the creation of the Federal Reserve. As Paul said, you can see that the dollar has lost around 97% of its value. That calculation uses the generous, government-massaged inflation numbers of the CPI.

Read more from Paul here.

Are the Goods Moving?

Long-time readers are familiar with Young Research’s Moving the Goods Index, a market-cap-weighted stock index made up of nonairline transportation companies. If I had to choose only one economic indicator to use, this would be it. Transportation companies lead the business cycle. The theory is that you have to move the goods before you sell them. If the index is reaching new highs, economic growth is likely improving. And if the index is dropping to new lows, economic growth is likely slowing.

For the last couple of years, since the end of the major Covid shutdowns, the index has been consolidating, with slightly higher highs and slightly higher lows. Keep your eye on my Moving the Goods Index as I post about it here. A breakdown could signal economic trouble ahead, and a breakout could signal faster growth to come.

If you’re worried about the economy and need a port in the storm, click here to subscribe to my e-mail alert.

CAUTION: Investment Extremists Can Get Wiped Out

In 1985, America was just coming off one of the worst bouts of inflation in its history. Much as today, with inflation trailing off but still a worry in everyone’s mind, an argument naturally broke out between extremists in the financial media over whether America was poised for reignited hyperinflation or a deflationary death spiral. I had recently pioneered the Financial Armadillo Strategy and was asked to add my voice to the discussion with an op-ed in the June/July 1985 issue of Reason magazine. Instead of piling on with more extremism, I wrote:

In the last decade, the world economy has become increasingly complex and unpredictable. Today, depending on the evidence being considered at the moment, you can make a compelling case for deflation and depression, hyperinflation, and every economic scenario in between. As an economic and monetary analyst, I have my own carefully considered opinions on the subject. However, they are opinions, not guarantees of the future. No one can be absolutely sure what tomorrow will bring.

The major protagonists in the deflation versus hyperinflation controversy are urging investors to choose sides. They claim an individual’s financial future depends on betting the right horse. This may be true for speculators trying to make a killing in the financial markets, but it is emphatically not the case for capital-preservation-oriented investors, who should be preparing themselves for any economic eventuality.

The “Financial Armadillo Strategy” is designed to preserve and enhance individual wealth in every conceivable future economic environment. Like the armored little creature from which it gets its name, the Financial Armadillo Strategy is both offensive and defensive in nature. It adapts to a wide range of investment climates and promises to endure, whatever economic upheavals may be on the horizon. The armadillo has survived since prehistoric times. Armadillo-strategy investors will be among those to survive what could truly be a tumultuous economic future.

Then, as now, I encouraged investors to avoid extremism and emotional advice in the face of the inflation-deflation argument. I concluded:

It’s not easy for individuals to ignore the often emotional advice given by financial pundits on either side of the inflation-deflation issue. Even an extremist can, on occasion, be correct, and those who follow such advice can make a quick killing. However, when extremists are wrong, their disciples can be wiped out. It’s better to be safe than sorry. The Financial Armadillo Strategy offers a common-sense way to deal with the unknown.

When you want to discuss common sense approaches to the investment unknown, visit www.younginvestments.com, and give my office a call. In the meantime, click here to subscribe to my free Young’s World Money Forecast email alert. It’s your port in a storm.

Dip a Toe into Gold

In June of 1993, Bloomberg’s Pam Black asked me how to stay ahead of the inflation curve. I told her to “dip a toe” in gold. I continued:

“Buy it with the idea that you won’t make any money. Hopefully, your other assets will do well, but if they don’t, you’ll be damn happy you were in gold.”

Take a look at the chart below, and you’ll see how gold and the dollar have performed since that article was published.

“Inflation Dodger”

You want a history lesson? In 1987, I was interviewed by The Kiplinger Magazine – Changing Times (which is known today as Kiplinger’s Personal Finance). This wasn’t long after I had written Financial Armadillo Strategy with the late David Franke.

At the time, America was coming off some of its heaviest inflation ever, and investors wanted a solution to the problem. Despite those high rates of inflation in the 80s, I warned that even somewhat more moderate rates of inflation—like those Americans have seen over the last two years—do real harm to investors. “I don’t mean 10% or 15% inflation; 4% or 5% is absolutely debilitating,” I said.

Even then—like today—I was focused on dividends and compounding to fight inflation. From Kiplinger’s:

Those nearing retirement want assets that are safe but lucrative—easier said than done. Young’s “financial armadillo” seeks to deliver on both counts. It’s designed to place a protective shell around your portfolio, while allowing it to forage for profits at will. This armadillo has but three legs: equities for total return, Treasuries and gold. “The average investor has no conception of what total return is all about,” says Young. “From 1936 to 1986, the compounded growth rate for the Dow was 4.8%. If you take shorter time spans, the results are similar. That’s much less than you would expect.” But when you add dividends, the total return is 9.4%, says Young. “Dividends are extremely important. They should be worth about half the game.”

Take a look at my chart below on the plight of the dollar since Nixon ended gold convertibility in 1971. Compared to the dollar then, today’s dollar is worth only 13.3 cents.

Americans have watched the dollar decline in value ever since the government severed the dollar’s last links to gold, a return to which I have always advocated. The author of the article dubbed me an “Inflation Dodger.” That’s a name I’ll proudly accept in light of the destruction of dollar value since the 1970s. When enduring that sort of purchasing power loss, all retirees may need to become inflation dodgers. To this day, dodging inflation guides much of my work at my family investment firm.

Biden’s Debt-Fueled Spending Binge and America’s Credit Rating

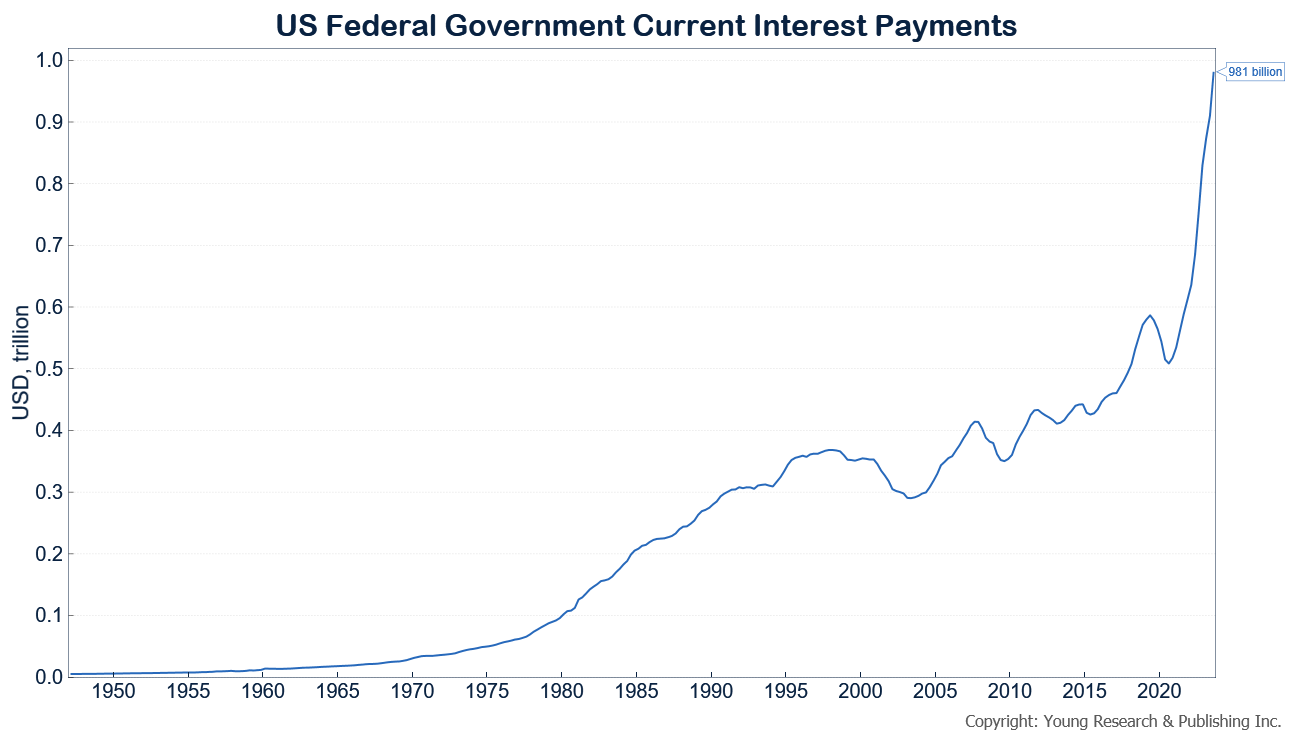

Since the “temporary” stimulus package of 2009 was enacted by Barack Obama and greased through the system by Ben Bernanke’s Federal Reserve, Americans have faced ever more burdensome budget deficits. After Joe Biden moved into the White House, the dangerous spending reached a new level. Uncontrolled money printing has set America up for some hard lessons as the interest on the federal debt rapidly closes in on $1 trillion a year.

This time around, the Federal Reserve isn’t running a bond-buying program while pegging interest rates at zero. Instead, the Obama/Biden-style spending will be forced to face the music on interest. Now, after years of profligate spending, Joe Biden has put America’s treasured credit rating at risk. On Friday, November 10, 2023, Moody’s Investors Service cut its outlook on U.S. sovereign credit to negative from stable.

In January of 2012, I wrote about the Obama-era downgrades of America’s debt in the Fall of 2011:

The international financial landscape today is far different than at any time in the past. I mean a lot different. Due to profligate mismanagement by our politicians in Washington, the U.S., for the first time in history, has lost its AAA-credit rating. Meanwhile, the Fed is pouring more and more high-octane fuel into the economic engine with increasingly foul results.

The downgrades are a symptom of the real problem, which is too much spending. Since inflation laid bare how badly accommodating Federal Reserve policy can mess things up, Biden’s overspending is exposed for the danger it is. Moody’s, S&P, Fitch, and all Americans will inevitably have to recognize the danger in Biden’s debt-fueled spending binge. Perhaps they will even do so before it’s too late.

- 1

- 2

- 3

- …

- 20

- Next Page »